Get Debt Relief in Swift Current, Saskatchewan & Eliminate Debt with Solutions, Options, Programs & Services

Credit card debt reduction and how to get out of debt: Settling what you owe, debt management, debt forgiveness letter, debt consolidation and more.

You need debt relief in Swift Current, Saskatchewan with a solution that works. While some ads make it sound easy, it is a process you need to be committed to – and we can help. In Canada there are many programs and ways to deal with debt.

It can be hard to choose from the wide selection of solutions and find the one that’s right one for you. It’s important to do your research, find online reviews or ask a trusted non-profit credit counselling organization for help.

Dealing with Debt Stress is Difficult – We Can Help

Let us help you get rid of stress and money worries in your life. If you lose sleep thinking about your debts, your credit cards are maxed or you’re not sure if you can pay all of your monthly bills, you need a solution that won’t get you deeper into debt.

Regardless of your situation, there is hope that you can be debt free. Your bank might have turned you down for a consolidation loan, but it is still possible to get back on track with your credit cards and debts. We’re here to help you.

Get started right now by speaking with one of our friendly Credit Counsellors. All you need to do is call us to make an appointment or ask just ask us some questions. Our appointments completely confidential and free of charge, and all of our Counsellors are friendly, professionally trained, and non-judgmental.

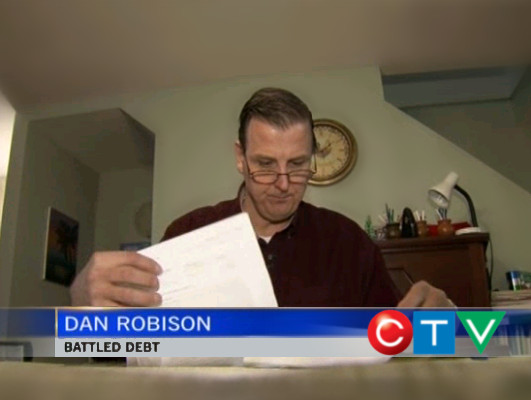

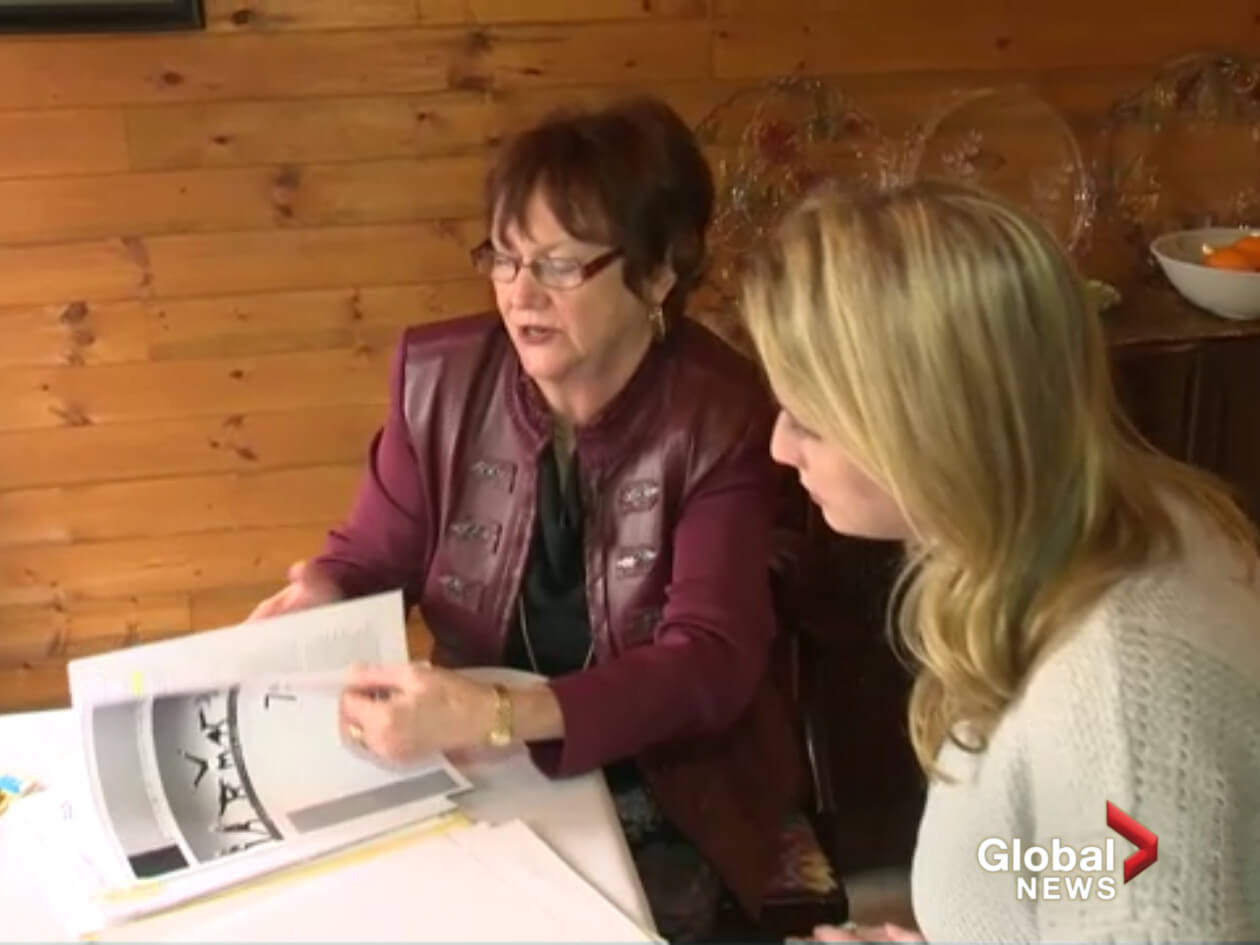

Global TV and CTV News Interview People We Helped

Occasionally, the news media will speak with people we helped who are comfortable with publicly sharing their experiences. Here are a few of their stories.

Reasons to Make a Debt Relief Plan Today

We can help you:

- Explore options to get out of debt and become financially stable again

- Pay back your debts with one affordable monthly payment

- Save thousands of dollars of interest payments

- Learn how to manage your money well and afford bills and living expenses

Contact us now. One of our qualified Credit Counsellors would be happy to help!

Explore Your Options to Get Out of Debt – Choose the Best One

When you start looking at what to do about your debts, it can be hard to know which option will work best. An experienced Credit Counsellor will answer your questions, explain the short and long-term consequences and give you the information you need to make a decision.

Some of the debt relief options and tips a Credit Counsellor serving Swift Current will explain are:

- Debt repayment and consolidation programs to make it easier to manage all of your bill payments and living expenses.

- Debt management programs where your creditors work with you to help you repay what you owe. In many cases your creditors will stop charging you interest.

- Help with your personal or family budget if you want to refinance an existing loan or mortgage.

- Referral to a bankruptcy trustee for information on going bankrupt if you are insolvent, or filing a Consumer Proposal if you can repay part of what you owe.

- How debt settlement works in Canada, including the advantages and disadvantages. Making one large payment in exchange for the rest of your debt being written off has long term consequences that you’ll want to know about ahead of time.

- How to research debt relief companies and find trustworthy reviews.

- How to communicate with creditors, stop stressful collection calls and write a forgiveness of debt letter.

- How to pay off government debt.

There’s Hope Beyond Debt

“The Credit Counselling Society gave us back our hope, and our future. We had been amassing credit card debt for years for our son’s medical expenses; just trying to keep our heads above the water. Even though my husband and I both worked full time and we didn’t spend frivolously, we couldn’t keep up with the interest. We just wanted to be able to pay what we owed without being harassed and gouged. The Credit Counselling Society got the credit card companies to freeze the interest, and allow us to make regular manageable payments without harassment. I highly recommend their services to anyone who is struggling with debt.”

– Anne Marie, Actual Client Review from Facebook

Ask a Credit Counsellor How to Get Out of Debt

Your Credit Counsellor will explain to you what you need to know so that you can start dealing with your debts right away.

Ultimately, the best option for you to choose will be the one that you can afford to follow through with, and then stay out of debt once and for all.

Next Steps to Take to Get Help with Your Debts

When you contact the right debt relief organization, you’ve got nothing to lose and everything to gain. Last year alone, close to 70,000 Canadians contacted us for help with their money and debts. 97% of them reported that they would recommend our service to others. We are also the winner of the 2021 Consumer Choice Award in many cities across Canada.

Give us a call now and find out how we can help you too. Once you know how to handle your situation, you’ll feel back in control.

Get Free, Confidential Debt Help – Talk to a Credit Counsellor Right Now

Appointments are free, confidential and available either in person or over the phone. Your Counsellor won’t judge you and you’re not obligated to anything after the appointment.

You have nothing to gain if you wait – Contact us now at 1-888-527-8999.

With free assistance available from a non-profit, certified credit counselling service in Swift Current, what’s stopping you from getting help today? Get relief from your debt and stress today.

Learn more about the Credit Counselling Society and why so many people, governments, professionals, and community organizations trust us to help individuals with their money and debt challenges.

We can help. Give us a call at 1-888-527-8999 or send us a quick note to call you back and we’ll be in touch to answer any questions you may have about debt. We’ll help you find a solution that works best for you.