Student Loan Debt – How Your Life Can Be Affected

and How to Solve Repayment Issues

by Kevin Jones

Student loan debt can sometimes be avoided. It’s no secret that high debt can negatively affect your life. This is especially true for graduates who face loan repayment issues. Borrowing money is usually easier than paying it back. It is quite common for students to work while attending school. Extra money can be used to pay down a student loan.

Sometimes students aren’t able to get enough work or need a lot of time to study. It can be tough to avoid college debt or university bills. This can set up a new graduate in a tough position. There is usually a waiting period before recent graduates become employed. Taking out a student loan is often the only way people are able to go to school.

You are reading part 3 / 4 in this student debt mini-series:

- Avoid Student Debt, Loan Purpose, Advice, Alternatives and What to Do if You Can’t Pay It Back 1 / 4

- Why Get a Student Loan, Are They Good or Bad and How to Overcome Repayment Problems 2 / 4

- Student Loan Debt – How Your Life Can be Affected and How to Solve Repayment Issues 3 / 4 – You Are Here

- How to Prevent Student Loan Debt and Pay It Off 4 / 4

What Is Good Debt? Good Debt vs Bad Debt

Is student debt really that bad? Is there a reason why you should avoid student loans? Taking out a student loan can be a good idea and can be seen as good debt. The difference between good debt vs bad debt walks a thin line. Taking out loans that help you move forward with your life goals is generally seen as good. For example, getting a degree can be the right decision for your future.

However, debt that starts out good can also turn bad. The negative effects of student loans can reach far into your post-graduation years. Understanding the benefits and drawbacks is important before you make a decision about funding your post-secondary education. Try not to stress over why you should avoid loans. Getting a student loan can be the very vehicle you need in order to have a career you enjoy. Why is student debt a problem then?

How Can a Student Loan Affect Your Life?

Delayed Goals, Net Worth and Financial Choices

Student loans can impact your lifestyle. If you’re still in high school or have just graduated, it might be hard to imagine all the ways that student loan debt can affect your life. You might be surprised to learn that the negatives are not just limited to the time after you graduate. For example, some students may question if what they’re studying is worth all of the debt that is building up. This might pressure them into rushing through their programs or sticking to fields they don’t really enjoy. Of course, a student loan will negatively impact you the most when you have to start paying it back. Here are three consequences of students accumulating tuition debt during their period of study:

- Delayed Home Ownership Goals

- Reduced Net Worth

- Limited Financial Choices

1. Delayed Home Ownership Goals

You may have to delay homeownership and live with parents or with roommates after graduation. Many young Canadians need to be ok with delaying their dreams of independence. Money that is needed for rent or a mortgage instead goes to student loan payments.

2. Reduced Net Worth

You also need to be ok with having a lower net worth compared to those who finish school debt-free. Graduating with debt means you might even have a negative net worth for years after graduation. This can make you feel behind on finances before you start your professional life. This and the pressure of making monthly loan payments may force you into taking any job. A paycheque is a paycheque. It is important to make your student loan payments on time. You don’t want to end up in big debt. This is a good solution while you are waiting to land an opportunity at your dream job.

3. Limited Financial Choices

If you don’t pay your student loan off quickly, it can limit your financial choices for decades. For example, earning a graduate degree might provide a career boost. However, if you already have student loans you may not be able to get another one. If you do not have an alternate source of income you may not be able to afford to get a graduate degree. Taking out loans may also make it more difficult to save money or for your future. This can impact your financial freedom to do the things you want to do. Any type of debt has the potential to affect you well into your life and even retirement. Money management for students can be difficult but we can help.

You May Not Qualify for a Mortgage if You Have a Bad Credit Report

What If You Need a Good Credit Score to Be Hired for Your Dream Job?

Some employers do credit checks. What if your desired workplace reviews your credit report and decides not to hire you because of it? If you made a significant financial investment to go to school in order to land a lucrative career then you need to plan ahead. This could mean picking up part-time jobs and building a personal budget to pay off student loan debt.

Avoid the Pressure of Student Loan Repayment

Plan Ahead and Make Your Payments on Time

A student loan may also pressure people into taking on additional debt just to get by. This could be in the form of credit cards, payday loans or unsecured loans. You may also reach out to employer(s), friends, or family. This can cause much strain on relationships and make you feel even worse. The best way to handle this comes from prevention. A budget for school can help. There are many warning signs of debt that you will want to pay attention to. Personal debt can become unmanageable very fast.

Consumer Proposals and Bankruptcies

Talk to a Credit Counsellor First

If you let things slide far enough it could eventually lead to a consumer proposal or the need to file for bankruptcy in Canada. Bankruptcy is, of course, always a last resort. If you are already considering this then contact us or call us at 1-888-527-8999 right away. If you have already reached out to an insolvency trustee for information it might be possible to pause the process. We can help.

Circumvent a Consumer Proposal or Bankruptcy

You Have Other Options You Can Explore First

We can assign you a credit counsellor who will go over all of your options with you. It is always in your best interest if you can circumvent a consumer proposal or bankruptcy. Both of these choices are recorded publicly. Anyone can look online to see if your name comes up. This usually has more of a negative impact on your life than a poor credit score. Consumer proposals and bankruptcies stay on your credit file for 7 years. Once you have completed your consumer proposal or are fully discharged from bankruptcy you can begin to rebuild your credit. It is a lengthy process.

What Debts Are Included in Bankruptcy?

Unsecured vs Secured Debt

Here is a vital piece of information. If it’s been less than 7 years since you have finished school, your student loan can not be included in bankruptcy automatically. There are many things that are included in bankruptcy. Student loans are treated separately. If you declare bankruptcy you may experience a seizure of assets and funds. These go towards paying down unsecured debts. There is a big difference between unsecured vs. secured debt.

Many Canadians Have Unpaid Student Loans

Whether you’re worried about how student loans can affect your life or are struggling with those effects right now, you’re not alone. Data from Statistics Canada shows that two-thirds of people across Canada still have not paid off their student loan. People who graduated in 2015 were still trying to pay it off in 2018. The median remaining debt is over $20,000. There are some debts you can wait to pay down but a student loan usually isn’t one of them.

The waiving of interest payments for government student loans due to the COVID-19 pandemic has no doubt helped lighten the burden. However, the pandemic’s impact on both student and graduate job opportunities is also immense. Millennials have the reputation of being the most indebted college students in history. 52% of those surveyed in the US still struggle with their student loan debt. This is very likely true for Canada as well.

Check the National Student Loan Service Centre (NSLSC) for Interest Relief

Use this Time to Pay Down Other Debts

If you’re dealing with multiple types of debt a short term strategy may be helpful. If there is any current interest relief for government student loans on the NSLSC website then you can focus on other debts. However, keep in mind that student loan interest rates are variable and fluctuate based on Prime lending rates.

In particular, the standard interest rate for federal student loans is 2.5% plus whatever the Prime rate is at the time. So in 2019, when the prime rate was 3.95%, the total interest rate was 6.45%. There’s no guarantee that interest rates won’t rise even higher in the future. It’s always better to have a clear plan for eliminating your debts sooner rather than later.

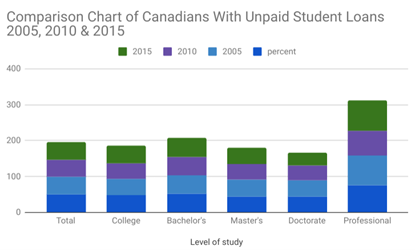

Comparison Table of Canadians with Unpaid Student Loans from 2005 – 2015

It is the new normal to have unpaid student loans. You just need to have a plan in place to pay them off. According to the National Graduate Survey of 2018 many Canadians have unpaid student loans from 2005 – 2015. Here is a visualization of this data provided by Statistics Canada.

How to Solve Student Loan Repayment Issues

It may seem like getting a student loan isn’t the best way to finance your education. So long as you have a roadmap of how to pay your student loan off it is definitely worth consideration. There are things that you can do to prevent student loan repayment issues:

- The NSLSC offers student loan extensions and repayment help

- Sometimes schools offer financial aid programs which can lessen your expenses

- You can borrow money from family or friends

- If you’ve found work sometimes certain careers will have forgiveness of debt programs

- See which professional organizations offer school funding you can qualify for

- Build a personal budget

- Find new ways to make money

- Talk to a credit counsellor

- Explore debt consolidation options for non-student loan debt

- See if a debt management program is right for you

Contact Us for Student Loan Debt Help

See How You Can Avoid Student Loan Debt

If you are unable to avoid student loan debt you are not alone. We often find Canadians struggle with paying back their student loans. This is usually because they’re also burdened with other debt. It can be hard to stop using credit cards, lines of credit, and high-interest personal loans. This can make it tough to pay off student loans. If you are in a similar situation our certified non-profit credit counsellors can help.

We will make an action plan and show you how you can overcome student loan debt or other debts that you may have. It doesn’t cost anything to book an appointment with us. We’re available to chat online or you can send an email with your question. If you’d like to get advice on your specific circumstances, please call us at 1-888-527-8999. Sleep better knowing that debt won’t affect your life forever.

Next up in this article series: Student Loan Debt – How Your Life Can be Affected and How to Solve Repayment Issues 3 / 4

Last Updated on December 6, 2024

0 Comments