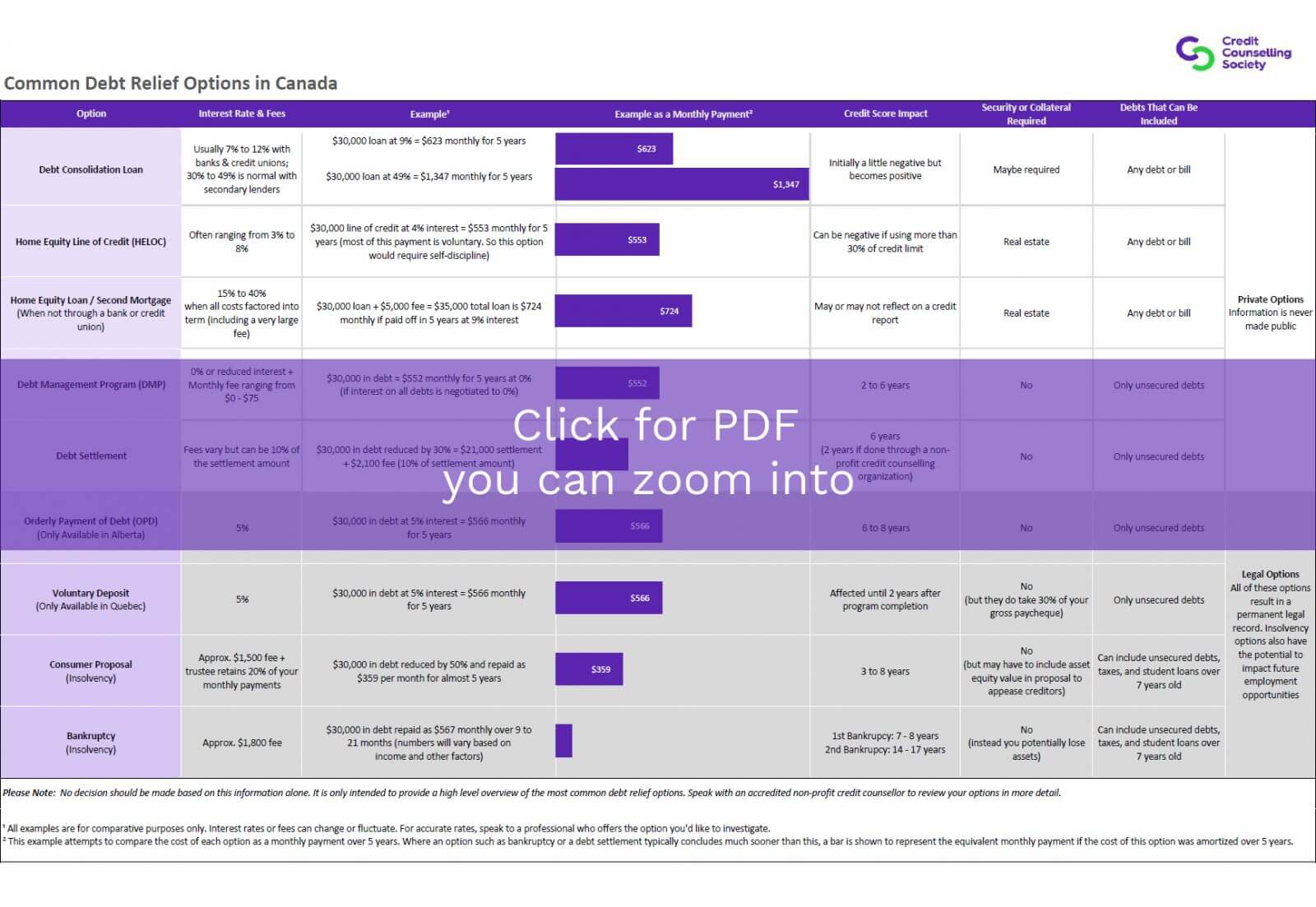

Common Debt Relief Options in Canada

A lot of people don’t realize it, but there are many debt relief and consolidation options in Canada. They range from debt consolidation loans to Debt Management Programs to Consumer Proposals. If you’re struggling to make your monthly bill and credit card payments and really need a way to get back on your feet, there’s likely some form of debt relief or consolidation that can help you. The trick is finding the right debt relief option for your situation that will do three things:

- Resolve your current financial problems as quickly as possible,

- Fit your situation as something you can realistically afford and stick with, and

- Allows you to accomplish your long-term goals.

Below is a chart that lays out many of the most common forms of debt relief available in Canada. While each option has many facets that can’t all be captured by a simple chart like this, it attempts to provide a high level overview of each option and how they all stack up when you look at different aspects of each one.

Your Next Step

As you can see, there are a lot of options, and this comparison chart only provides a general overview of each one. To get into all the details of each option and see which one might be able to help you the most, you either need to talk with a professional who offers a specific option or speak with a local, non-profit credit counsellor who is very familiar with all of them and is trained to help people find the best one for their particular situation.

If you’d like to explore all your options with one of our professionally trained and certified credit counsellors, give us a call and make an appointment. Our appointments can be over the phone or in-person – whichever is easier for you. If you’d like to quickly get an idea of what options may be available to you, respond to the questions below.

Discover Your Options

A Visual Overview of Possible Options

Here are some options that may be available to you based on the information you have provided about your financial situation. The most likely options are in green, less likely in yellow, and least likely in red. This is only intended to provide you with a general idea of the options that may be available to you. A credit counsellor will need to go over your information in much more detail to make a more precise determination.0

Option

![]()

Do a Deeper Dive to Uncover More Options

It looks as though your situation requires more in-depth analysis from a trained credit counsellor. They can help you optimize your budget, explore options, and create a plan to get back on track.

0

Option

![]()

Self-Managed Solution

After thoroughly exploring your options with a credit counsellor, they can help you put together a plan to get out of debt in a reasonable amount of time. You can then implement this plan on your own.

0

Option

![]()

Debt Consolidation Loan

Based on the information you've provided, it appears as though this could be a possibility if your credit score is strong enough.

0

Option

![]()

Debt Management Program

It appears as though this may be an option for you. A Debt Management Program eliminates or drastically reduces interest and consolidates all payments into one.

0

Option

![]()

Consumer Proposal

This may be an option for you to consider. It's a legal process that consolidates all payments into one. Talk to a credit counsellor about this and see if it makes sense for your situation.

0

Option

![]()

Bankruptcy

Based on the information you've entered, it appears as though bankruptcy may be an option to resolve your financial challenges. You should speak with a credit counsellor about this and make sure you've exhausted all other options first.

0

Option

![]()

Orderly Payment of Debts

Based on what you've entered, it looks as though an Orderly Payment of Debts (OPD) program may be an option for you. To find out if this would make sense for your situation, you should speak with a credit counsellor.

0

Option

![]()

Voluntary Deposit

Based on the information you've provided, it looks as though a voluntary deposit program may be an option to address your debt situation.

0

Bonus Option

![]()

Online Workshops

Learn how to improve your financial situation, create a budget, make your dollars stretch further, and get out of debt with one of our many helpful online workshops we call webinars.

More Specifics on How We Can Help You

Get Help Today

Give us a call to speak with one of our credit counsellors at 1-888-527-8999, or if you'd like us to contact you instead, please fill out the form below.

Related Articles

Credit Counselling

Are you curious about what credit counselling is or how it works? Here’s what you need to know.

Client Reviews

Directly from our clients, read and hear about their experiences with CCS.

Getting Rid of Debt

We’re happy to help you figure out your options. There are more than you might think.