Solutions to Debt Problems in Kitchener, Ontario – We’re Here to Help

How to Manage and Overcome Major Debt Problems in Kitchener

Debt problems can happen to anyone in Kitchener, Ontario, and the one thing debt problems have in common is the huge stress, worry and sleepless nights they cause. If you’ve got a problem with debt, let us help you find the right the solution so that you can sleep better and not worry about your money and bills anymore.

How to Overcome Serious Debt Problems

When you are looking at how to overcome major debt problems in Kitchener, the best course of action is to tackle them sooner rather than later. Simply hoping and waiting for things to improve will likely result in less options being available to you down the road.

If you’re not sure what to do or where to start and you’d like some guidance or information, feel free to call us or anonymously chat with us online. We’re happy to answer your questions or help you make an appointment to speak with one of our accredited Counsellors confidentially. There is never any charge for our appointments, and we don’t obligate you anything.

Our professional, friendly Credit Counsellors will help you get started with a realistic plan that’s broken down into doable steps that will get you back on track. Some of what they can help you with is:

- Creating a spending plan to make sure all your debts and household bills are taken care of

- Showing you what you can begin doing right away to start addressing your debt problems

- Exploring options that will allow you to pay back your debts or find alternative options to filling for bankruptcy if you can’t reasonably afford to pay back all of the debts you owe

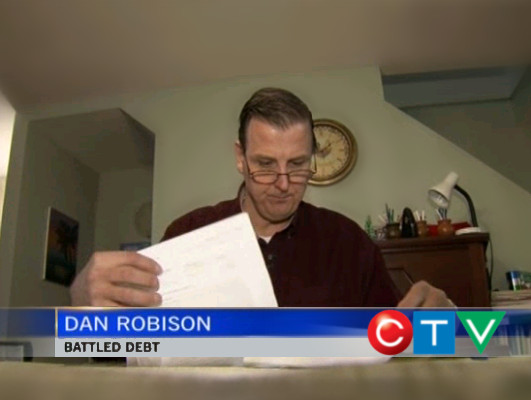

People We’ve Helped Interviewed on CTV News and Global TV

At times, the news media will interview one of the people we helped who are comfortable sharing their story with the public. Below are three of these stories.

Serious Debt Problem Warning Signs

Sometimes someone may experience a sudden improvement in their situation which will allow them to get back on track without needing help from anyone else. However, if you’ve been battling debt problems for over a year, then pay attention to these warning signs. They often reveal more serious debt issues.

To figure out if you need some assistance to get your debts back on track, ask yourself:

- Is debt stress making it more difficult to deal with everyday life?

- Do you notice that you are no longer getting ahead simply making minimum payments?

- Have you been declined for a debt consolidation loan?

- Do you depend on your credit cards, line of credit, or overdraft to make ends meet each month?

- Are you on the receiving end of collection calls or letters?

- Does your financial situation cause you embarrassment?

- Are you losing sleep at night because of worry over money problems?

If you responded “yes” to any of these questions, then it’s highly likely that you need assistance putting together a plan to get your finances back on track and eliminate your debts. One of our Credit & Debt Counselors would be happy to help you. Speak with one today.

Options and Solutions to Resolve Debt Problems

Worry over money and debt problems can make you sick from all the anxiety and stress. In addition to all this, we see many people coming to see us who are afraid about what may happen to them.

Helping you work through various options and solutions for your debt challenges is only part of the help we provide. We also want to make the time to answer any questions you may have about money management, credit, and debt issues so you can make an informed choice about what to do and how you would like to deal with your debt problems.

Feel free to use the phone, anonymous online chat, or email to ask us your questions or to make an appointment to talk with one of our Debt Counsellors. Appointments with the Credit Counselling Society’s Counsellors are available in person or over the phone and are always free, non-judgmental, and completely confidential.

Extra Information About How to Manage, Fix, and Overcome Debt Problems in Kitchener, Ontario

If you’re curious or if you want to learn more on your own, here is information about some of the topics we receive the most questions about from Ontarians who are looking for solutions on how to manage, fix, and overcome their debt problems.

- 12 of the Fastest and Most Effective Ways to Get Out of Debt & Pay Down Debt in Ontario

- How to Handle & Stop Collection Calls and Demand Letters

- Debt Consolidation Loans & What to Do if You’re Declined in Kitchener

- Info on Alternatives to Filing Bankruptcy in Kitchener

- Information About Debt Management Programs

Call us at 519-340-1013. We’re here to answer your questions or refer you to the most qualified, professional who can provide you with the advice or solution you require.

Placing Your Interests First

Our highest goal is to always put you first and look out for your best interests in all we do. One of the ways we do this is through accountability and transparency. Our organization and its staff are held to the most rigorous standards of accountability in our industry.