Does It Make Sense to Raise Your Credit Card Limit or Do a Balance Transfer with Convenience Cheques?

By Julie Jaggernath

Have you received an offer to raise the limit on your credit card? You know the ones, about how the credit card company wants to recognize your excellent credit history by giving you access to more credit.

It used to be that credit card companies could raise your limit without asking you, but the rules in Canada changed about 4 years ago for federally regulated financial institutions; now they need to get your permission first. (If you’re curious, the Bank Act specifies who the federally regulated financial institutions are.)

I got another letter last week, offering to raise my limit by more than double, and along with it came 3 credit card convenience cheques that I could use for balance transfers.

While the offer was momentarily tempting, let me share a few details with you about why I quickly pushed all the paperwork through my shredder.

Higher Credit Card Limits Can Lead to Temptation Spending

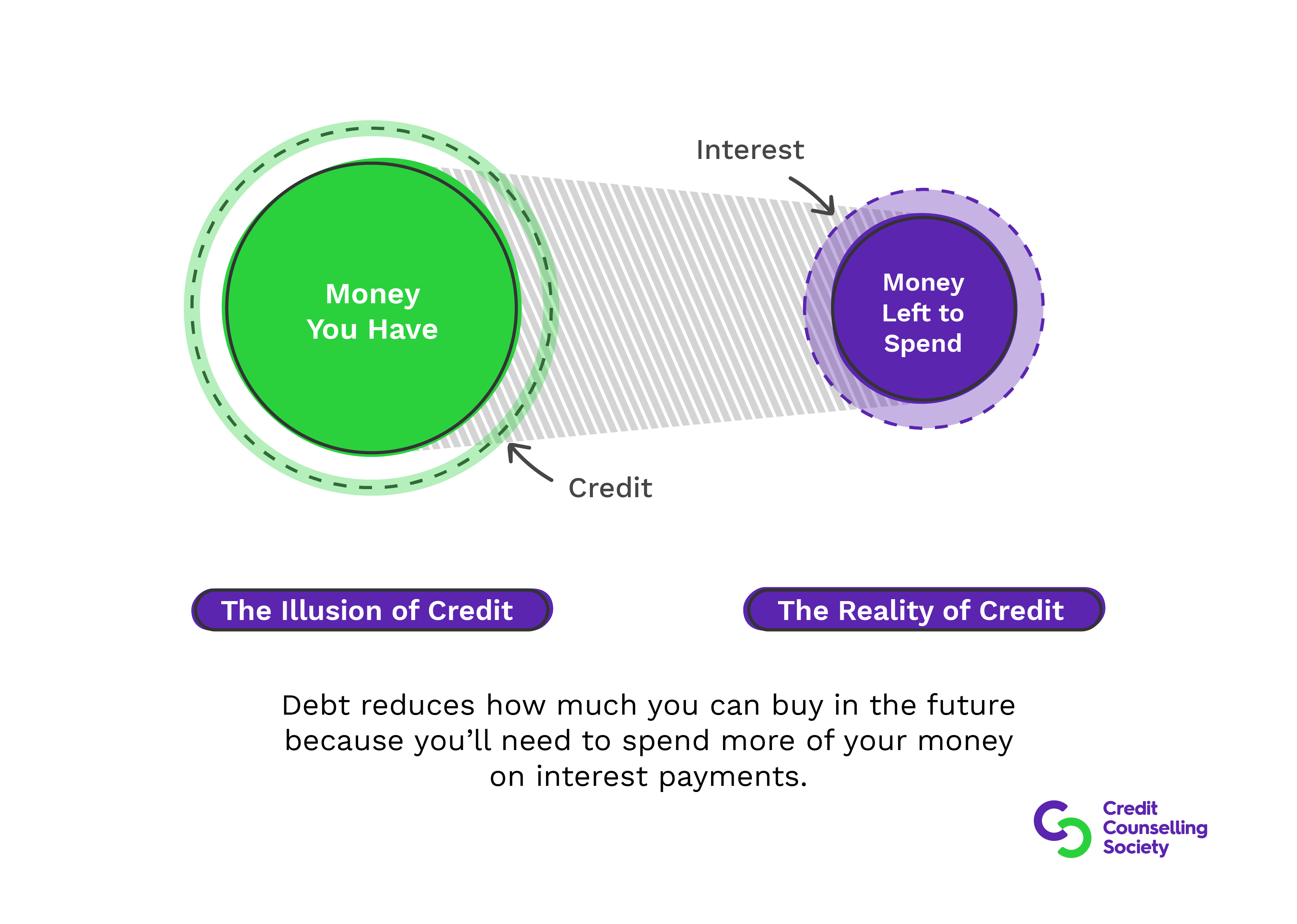

High credit card limits can make you feel richer than you really are. It’s easy to spend more than you intend to spend when you’re shopping with what seems like an endless amount of (someone else’s) money.

In truth, the problem isn’t the credit card. It’s just a piece of plastic, so depending on how you use it, it’ll either be a flexible friend or foe.

High Credit Limits Impact Qualifying for a Car Loan, Personal Loan, Line of Credit, Debt Consolidation Loan or Mortgage

If you anticipate needing to borrow money in the next few years, keep the limits on your credit cards reasonable and in line with what your income allows you to repay. Higher limits on your existing credit accounts, even if you don’t fully utilize them, will limit how much you qualify for with any new or refinanced personal loan, debt consolidation loan, mortgage, car loan or line of credit.

I don’t anticipate borrowing any time soon, but no one ever really knows what life has in store for us, so it’s best to keep your financial house in order, just in case.

Related: How Much Debt is Too Much?

What is a Credit Score & How is a Credit Score Calculated?

High Credit Card Limits Leave More Opportunity for Fraud

The credit card offer I received was for my “online” credit card, not for the credit card I use for in-person purchases. I have a separate credit card for online buying and I deliberately keep the credit limit low. If someone should get the number and use it fraudulently, at least I’m doing my part to try and minimize the damage.

How to Stop Credit Card Limit Increases & Not Tempt Yourself into Credit Card Debt

With my regular, in-person credit card, I contacted the company and asked them not to send me any offers to increase my credit card limit. I’m not going to accept them anyways, because I have what I need and don’t want to risk getting into debt that I’ll have trouble repaying, so there’s no reason to tempt me.

Credit Card Convenience Cheques

Now, as for those “convenient” credit card cheques, they went through my shredder first. Financial products don’t come with a whole lot of instructions, and the fine print can be hard to read. However, this is one time when it’s worth making the effort so that you know what you’re getting yourself into.

What is a Credit Card Balance Transfer?

A balance transfer is when you use one credit card to pay another. You might even call it “robbing Peter to pay Paul.” Credit card companies will send you convenience cheques, or an authorization form, so that you can use a new or existing credit card to pay off all or a portion (up to your limit of available funds) of what is owed on another credit card. How convenient, but for whom?!

How Much Does a Balance Transfer Cost; Is There a Fee? Can It Help with Credit Card Debt?

Balance transfers typically charge you a fee, a percentage based on how much you transferred. This is in addition to interest, which is charged right away, not after an interest-free grace period has ended.

The catch with balance transfers is that they are considered cash-like transactions and if they have a low, introductory interest rate offer, without some very careful budget planning, you may end up with a balance owing that’s higher than the one you started with.

To use the low interest rate offer effectively to manage other credit card debt, you need to budget payments that will pay off your whole balance owing before the low interest period ends. That’s where many people run into trouble.

To pay off $10,000 at a low interest rate of 1.9% (APR, annual percentage rate) for 9 months, that would mean making payments of $1126.95 each month (show calculation). Can you really afford to do that?

If it were that doable, everyone would be doing it. But budgeting for big credit card payments is hard. That’s why many people who get stuck in the minimum payment trap start looking for better ways to deal with their debt, or if it gets really bad, alternatives to bankruptcy.

How Credit Card Cheques or Convenience Cheques Work & Why They Cost So Much More

The purpose of credit card cheques is so that you are able to use your credit card for cash-like transactions or when credit card purchases aren’t possible (like paying rent or daycare). Using a credit card cheque is considered a cash advance, so unlike with charging a purchase, cash-like transactions accrue interest right away, typically at a higher rate than charged purchases.

There is no interest-free grace period until your statement due date, as there is with normal purchases, and you keep paying interest until the amount of the cheque has been paid in full.

What are “Cash-Like” Transactions & Cash Advances with a Credit Card?

Convenience cheques aren’t the only form of cash-like transactions. It is possible to withdraw money from your credit card through a bank machine or at a teller, up to your available limit. This is called a cash advance and it is just as expensive as writing a credit card cheque.

Additionally, it is possible to be charged higher interest and/or fees on purchases deemed to be cash-like transactions by your credit card company. Convenience costs, and buying cash is no exception.

Check your cardholder agreement to see if they consider gaming transactions, e.g. buying lotto tickets, casino chips or placing bets, as cash-like transactions. Each card is different, so there may be other cash-like transactions to be aware of as well.

The Benefits of Using a Credit Card

Just like with any tool, if you use a credit card wisely, there are benefits. For some people, they prefer to carry a credit card rather than cash, and others collect reward points with their credit card. When your budget allows you to pay your credit cards off in full every month, without incurring additional debt elsewhere, they can be a free, convenient way of managing money.

What to Do If You’re Worried About Your Credit Card Debt and Don’t Want to Raise Your Limit or Use Convenience Cheques for a Cash Advance

If you’re one of the many Canadians who rely on their credit cards to make ends meet, take the time to understand the ins and outs of your card holder agreements. This will allow you to minimize your costs while you create a plan to manage your money better. Raising the limit on your credit card or using convenience cheques for a cash advance will not solve your debt problems.

If you need help creating a budget and dealing with credit card debt and household bills, contact a non-profit credit counselling service for free guidance, information and help to get back on track. Having a plan to deal with your money and debt troubles will ease your stress and worries. All you’ve got to lose is your debt!

How to Calculate What a Low Interest Credit Card Offer Really Means

For the example above, here’s how the calculation works:

$10,000 x 1.9% = $190 (total interest charged in 1 year on $10,000 at 1.9%)

$190/12 = $15.84/mth (interest charged per month) on $10,000

$15.84 x 9 months = $142.56 + $10,000 = $10,142.56 / 9 = $1126.95/mth

This is just a quick way to tell how much your payments would be. With a decreasing balance, your actual payments would vary by a few dollars. This calculation also doesn’t take into account if you make other purchases with your card before the $10,000 is paid off.

Related: 12 Tips to Use a Credit Card but Not End Up in Debt

0 Comments