Money Management Blog

Welcome to the Credit Counselling Society’s Blog.

Debt Help Blog

Bankruptcy, Budgeting, Credit Counselling & More

Learn all sorts of great ways to manage your money better, solve your debt problems, and use your credit more wisely. We also tackle a lot of credit myths and misconceptions. Do you have questions about money management, budgeting, or credit? If you need advice or help with your debts email us your questions or chat with us online. We’re happy to help.

Select a Category

Trying to get a debt consolidation loan with bad credit in Canada? Know the what, why, and how of consolidating with a loan, plus its dangers and alternatives.

Practical budgeting tricks for beginners and the experienced alike to help keep your catch-up spending within your means and easy on your wallet post-pandemic.

Student loan debt can affect your life in many ways. Read about the negative effects of having a problem repaying this kind of debt and who can help solve it.

Ever gotten a credit card limit increase offer in the mail or online? Accepting it can help or hurt your finances. What to know before making a decision.

Knowing the differences between secured and unsecured debts can help you choose the types of loans or other debts that work best for your financial situation.

When you need cash now, applying for an instant online payday loan e-transfer can seem like an easy solution. Here’s why it’s anything but.

Join the #LearnWithCCS gift card draw for monthly chances to win $50 while learning how to use money wisely and get out or stay out of debt. Entering is free!

Not sure how much debt is too much and worried you might be in trouble? Here are 5 warning signs of debt to watch out for and what you can do about them.

A credit card balance transfer is one path to dealing with debt in Canada. Here’s what to know before trying debt consolidation through this option.

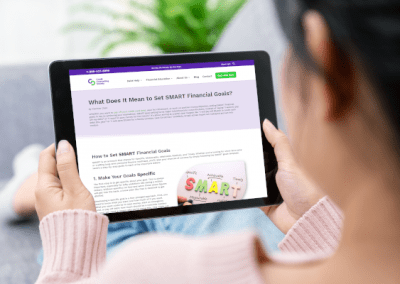

Learn how to set SMART financial goals to help achieve your objectives, whether it’s to pay off credit card debt, save for retirement, or another money goal.

Disputing incorrect credit card charges helps protect your hard-earned cash. Learning how chargebacks work now could save money and frustration later on.

Building a good credit history is important for using tools like credit cards and mortgages. However, your credit score isn’t worth obsessing over. Here’s why.

No results found.