Credit Counselling Services in Canada

We offer confidential, non-judgmental, free credit counselling to help you solve your financial challenges.

Credit Counselling Services of Canada – Free Non-Profit Help

Serving Canada with Free Debt & Credit Help

Credit Counselling Canada – Are you struggling to make your minimum payments? Maybe you’ve got debt problems that are affecting your sleep, your health, or even your relationships. We can help put an end to your stress.

Non Profit Consumer Credit Counselling

Debt Solutions from Canada’s Leading Service Provider

We’re a non-profit service providing consumer debt and credit counselling services to Canada. We can help you explore all your options and find the right solution for your situation. Our experienced, professionally certified counsellors can also help you create a plan to:

- Create a spending plan to manage all of your living expenses.

- Get your finances back on track.

- Consolidate your debts in Canada with one monthly payment.

- Save thousands of dollars in interest.

- Stop collection calls from creditors.

Find Out Exactly How We Can Help

by Answering 4 Simple Questions

Not sure where to start in finding help for your specific financial situation? Answer these 4 easy multiple-choice questions to get pointed in the right direction. All you have to do is click the boxes that apply to you and then the green button when you're done.

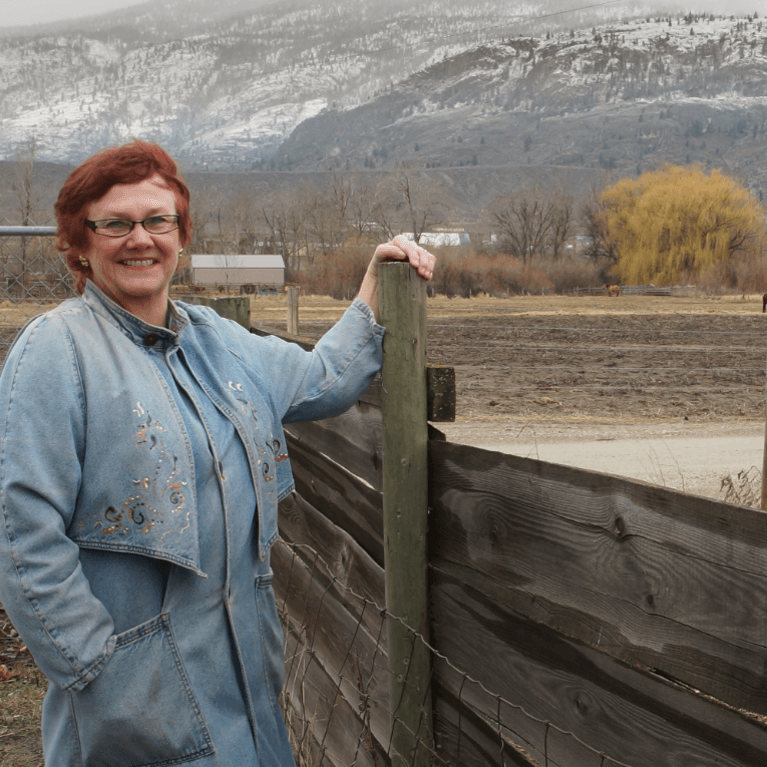

People We Helped Interviewed on Global TV and CTV News

From time to time, the news media interviews some of the people we helped who are comfortable sharing their story publicly. Below are three Canadians who shared their experience with the Credit Counselling Society.

Providing Free Consumer Credit & Debt Counselling Services

Helping Canadians for 29 Years

With 98% of our clients surveyed reporting they would recommend our services to others,

There’s a way out of debt with help

I had just come to the point where I had given up hope, that there’s no way I could ever repay my debt. A friend of mine suggested I reach out, and I thought I’d get some condescending person on the phone lecture me about money, but my counsellor was the most compassionate caring person who became sort of my own personal cheerleader.

Charis

More Info About the Credit Counselling Society & Our Approach

We’ve been providing non-profit consumer credit counselling since 1996. We typically end up helping around 95% of people who contact us completely free of charge. The only time someone pays for our services is if they decide to go onto our Debt Management Program. A lot of people view this program as a credit card consolidation since it consolidates all of someone’s credit card payments into one affordable monthly payment with either no interest or an interest rate that’s significantly reduced. While this is a tremendous program that protects peoples’ privacy, allows them to restore their credit, eliminates their debt, and gets their finances back on track as quickly as possible, this is only one of many ways that we help people.

We truly believe that the best debt consolidation or debt help is a solution that enables someone to get back on the right track as soon as possible while at the same time helping them accomplish their long term financial plans. Regrettably, the way we approach this is very different from the way some commission focused debt advisors, credit consultants, financial counselors, and credit advisors out there do things, but we firmly believe that when someone is having a difficult time financially, you need to carefully look into all options available to them and concentrate on what’s going to do the most to help them in the long-term. This is why we don’t pay any of our staff commission – only straight salaries. In addition to this, to ensure our organization meets the highest national and international standards, we decided to join, open ourselves to audits by, and become accountable to the most respected organizations in our industry in Canada and North America, Credit Counselling Canada and the National Foundation for Credit Counseling. We also report to a volunteer board of directors and to the Canada Revenue Agency. We’re also the only Canadian organization in our industry to annually open its books to an external auditor.

If you’d like to speak with one of our professionally trained Credit and Debt Counsellors, take a look at your financial situation, and see what options you have to get back on track, call us today at 1-888-527-8999. We’re here to help you.

The Credit Counselling Society also provides alternatives to bankruptcy in Canada.

Having Trouble With Your Debts?

We can help. Give us a call at 1-888-527-8999 or send us a quick note to call you back and we’ll be in touch to answer any questions you may have about debt. We’ll help you find a solution that works best for you.

Putting Your Interests First

Our goal is to always put consumers first and look out for their best interests in everything we do. One way we do this is through transparency and accountability. We are held accountable to the most rigorous standards in our industry.

Provinces & Territories We Serve

BC | Alberta | Saskatchewan | Manitoba | Ontario | Quebec | New Brunswick | PEI | Nova Scotia | Newfoundland & Labrador | Yukon | Northwest Territories | Nunavut

Was this page helpful?

Thanks for letting us know.

Related Articles

Debt Management Program

You’re not alone if you’re wondering if a DMP is right for you. Here’s what it is and how it works.

Our Qualifications

Our counsellors are friendly, professional, and among the highest qualified in our industry.

Client Reviews

Directly from our clients, read and hear about their experiences with CCS.