Personal Bankruptcy Aldergrove – Facts, Options & Alternatives | BC

No one wants to file for bankruptcy. Find other options and get more information before taking such a drastic step.

Personal Bankruptcy in Aldergrove, BC – When you can’t afford to pay your bills and debts what comes to mind first? Many people think of filing for bankruptcy. While bankruptcy might be the right solution for you, you first need to find out about your other options, the ins and outs of the process, and how it will affect you and your family in the future. We want to help you avoid making a huge mistake by giving you information to make an informed decision.

Find Out What Options May Be Available to You

by Answering 9 Simple Questions

Just answer these easy, multiple-choice questions to get a look at your potential options. Within a few minutes, you'll be looking at summarized options and results that apply specifically to your situation.

Discover Your Options

Types of Debts – What Bankruptcy Can’t Do

Bankruptcy isn’t something most people want to talk about with their friends. Yes, bankruptcy gets rid of most of your debts, but did you know that there are some debts you might still have to repay because they can’t be included in your bankruptcy?

3 common types of debt that aren’t included in a bankruptcy are:

- Secured debts, like a mortgage or car loan

- Student loans that are less than 7 years old

- Child and alimony support payments that you’re behind on

Many people think that they need to declare bankruptcy because of their credit card debt, but if that debt is recent, creditors may not allow you to eliminate those balances with bankruptcy.

The Bankruptcy Process – Working with Your Trustee to Obtain Your Discharge

Those who have gone bankrupt might not tell you that it takes a minimum of 9 months to complete the bankruptcy process. There are costs and fees to go bankrupt, which you pay to your trustee, as well as bankruptcy counselling sessions you must attend. Depending on your circumstances, you may also need to pay extra to your creditors, which delays completing the process and obtaining your discharge. Not everyone loses their home and assets when they file for bankruptcy, but assets above what you’re allowed to keep in BC will be sold by your trustee.

Many people aren’t aware that their trustee, their creditors, the Office of the Superintendent of Bankruptcy or the Court could oppose or delay their discharge from bankruptcy. Depending on someone’s situation, they may need to attend a hearing, answer questions under oath and/or meet additional requirements to obtain their discharge.

Your Credit Report & Bankruptcy in Canada

Bankruptcy is noted on your credit report and seriously impacts your credit rating. Despite what people say, getting credit after you have eliminated your debts legally through bankruptcy is not easy. It takes patience and time to prove yourself to creditors again. Until they trust you enough to lend you money again, your financial plans might be on hold because you won’t be able to take out a loan, renew your mortgage or apply for a low interest rate credit card.

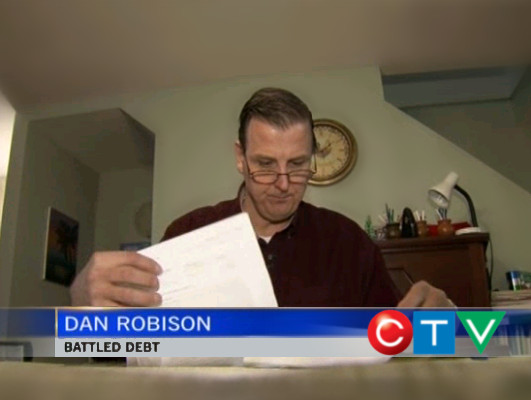

People We Helped Interviewed by the News Media

Occasionally, the news media will speak with people we helped who are comfortable with publicly sharing their experiences. Here are a few of their stories.

See even more of the Credit Counselling Society on the news.

BC Bankruptcy Alternatives

By now you may be wondering which alternatives to bankruptcy could work for you. There are a number of options and the best solution might mean combining some of them. Depending on your circumstances, 4 options that you may not have considered are: consolidation loans, debt repayment programs, debt settlement options or a Consumer Proposal.

Debt Consolidation & Debt Repayment Plans

When you hear the words “debt consolidation,” you probably think that this means consolidating your bills and other debts into a new loan. This could work for you if you’ve got a realistic budget. For many people, it makes more sense to consolidate only their monthly payments. Don’t worry if you’ve been turned down for a consolidation loan by your lender. There are other types of debt consolidation to consider.

If you happen to have bad credit, you might be worried about consolidating your debts, but consolidating payments doesn’t mean borrowing more money, so credit problems aren’t an issue. That’s how a debt management program with a non-profit credit counselling agency works. Your creditors help you by lowering or waiving interest charges. This makes smaller payments possible, saves you thousands in interest and lets you pay back what you borrowed. Your monthly payments are based on what you can afford and there’s no loan to get you deeper into debt.

Settle Debt

Repayment and consolidation programs or loans help you pay back what you borrowed – which is a good thing because most people really don’t want to file for bankruptcy and walk away from their debts. However, sometimes it’s possible that only paying back part of a debt may be the best solution. That’s where a debt settlement with a reputable company might help. Offering creditors a settlement requires a lump sum of money, but sometimes that’s not as far-fetched an option as you might think.

Filing for a Consumer Proposal

There are also times where you need a legal alternative to bankruptcy, so a Consumer Proposal might be right. A Consumer Proposal in Aldergrove is set up by a trustee, and once agreed to by your creditors, you make monthly payments to repay part of what you owe.

Which Option is Best?

As you can tell, a lot depends on your situation. When you’re just trying to make ends meet and duck the collection phone calls, you need help looking at your circumstances objectively. You need a professionally trained Credit & Debt Counsellor to help you come up with a good plan.

There’s a Way Out of Debt Without Bankruptcy

“I’m so grateful for the help of The Credit Counselling Society. I honestly didn’t know what to do. I got myself in debt way more than I could handle. And it’s nice to know that I’m paying off my debt with their help rather than claiming bankruptcy. Thank you so much everybody that spoke with me at the credit counselling.”

– Tammy, Actual Client Review from Facebook

Non Profit Bankruptcy & Credit Counselling Information & Advice in Aldergrove, BC

One of our expert Credit Counsellors can help if you need answers to questions about joint debts, have questions about debts left over from a divorce, want to learn more about alternatives to bankruptcy, or want to know more about how going bankrupt would affect you. They are experts in helping people come up with good solutions to deal with their debts, and would be happy to provide you with the information you need to make an informed decision to get your finances back on track.

Your Counsellor will:

- Explain all of your bankruptcy alternatives and debt relief options

- Show you how to budget effectively for all of your household expenses

- Recommend bankruptcy trustees in Aldergrove if it looks like declaring bankruptcy is the right option

- Provide answers and information so that you can choose the best way of dealing with your debts

Office Previously Serving Aldergrove

Suite 101A – 33140 Mill Lake Road

Abbotsford, BC V2S 2A5

(Currently, our credit counsellors who serve from this office are providing telephone appointments only)

Phone: 604-859-5757

Our office that serves Aldergrove also offers bankruptcy alternatives in Langley, Murrayville, and Mission.

We are experts in helping individuals and families just like you find good solutions to their debt problems. It really is possible to get back on track and look forward to being debt free. To find out more or to schedule a free, confidential appointment with one of our Credit Counsellors who serves Aldergrove, contact us today at 604-859-5757, email us or chat with us online.

Putting Your Interests First

Our goal is to always put consumers first and look out for their best interests in everything we do. One way we do this is through transparency and accountability. We are held accountable to the most rigorous standards in our industry.

The Credit Counselling Society also offers assistance to people who need help with their payday loans in Aldergrove (even online ones).