Debt Relief in Canada

Debt Relief Canada & Debt Elimination Solutions

Debt Relief Options, Services Programs in Canada

Credit card debt reduction and how to get out of debt: Settling what you owe, debt management, debt forgiveness letter, debt consolidation load, consumer proposal, and more.

Do you want debt relief in Canada and solutions that work? Some ads make it sound easy, but finding the right solution is a process – and we can help. In Canada there are many options to deal with debt.

It can be hard to choose from the wide selection of debt relief services and solutions to find the one that’s right one for you.

You may have questions like: Which debt settlement companies can I trust? What is the best debt relief program for me? What is a licensed insolvency trustee? It’s important to do your research, find online reviews or ask a trusted non-profit credit counselling organization for help.

7 Government Debt Relief Programs

Many individuals and businesses who are facing problems with their outstanding debts are looking for government debt relief programs to help them manage their finances and pay off outstanding debts. In Canada, the government does not directly provide debt relief programs on a regular basis (outside of significant national or regional emergency situations). However, the government does support debt relief in the following ways (some sales people call some of these supports government debt relief programs, but as you can see below, that’s not exactly true).

Debt Consolidation: This is the process of consolidating your debts into one big loan with a lower interest rate. It also simplifies the repayment process. The federal and provincial governments indirectly support debt consolidation in a number of ways. The Canadian government supports this by regulating banks and credit unions who offer debt consolidation loans which can help debt-ridden individuals and businesses. It’s helpful to know that loans provided by finance companies that are not banks or credit unions are not as carefully regulated by the government and can often have very high interest rates and fees. Sometimes these interest rates and fees can be so high, that they don’t make financial sense. Talk with one of our credit counsellors if you’re dealing with super high interest rates or significant fees. There is most likely a better way of doing things.

Debt consolidation loans can provide some debt relief, but if you don’t carefully plan your spending and limit your use of credit while repaying the loan, you may end up re-accumulating the debt and be right back where you started by the time you finish paying off the consolidation loan.

How do you find the debt relief program that will work for you? You can try this self-assessment tool to see what options are available to you.

Debt Settlement: It is about negotiating with creditors to reduce the amount of debt you owe them. Although the government doesn’t directly provide such programs, it provides some regulation of the industry through a small number of provincial consumer protection laws or regulations.

Orderly Payment of Debts: This program allows all unsecured debt to be combined into one monthly payment at 5% interest. It’s run through the courts and is now only available in Alberta. Many provinces used to offer a program like this but have abandoned them in favour of the Debt Management Program (see below) which usually results in lower interest and is completely confidential (no court record).

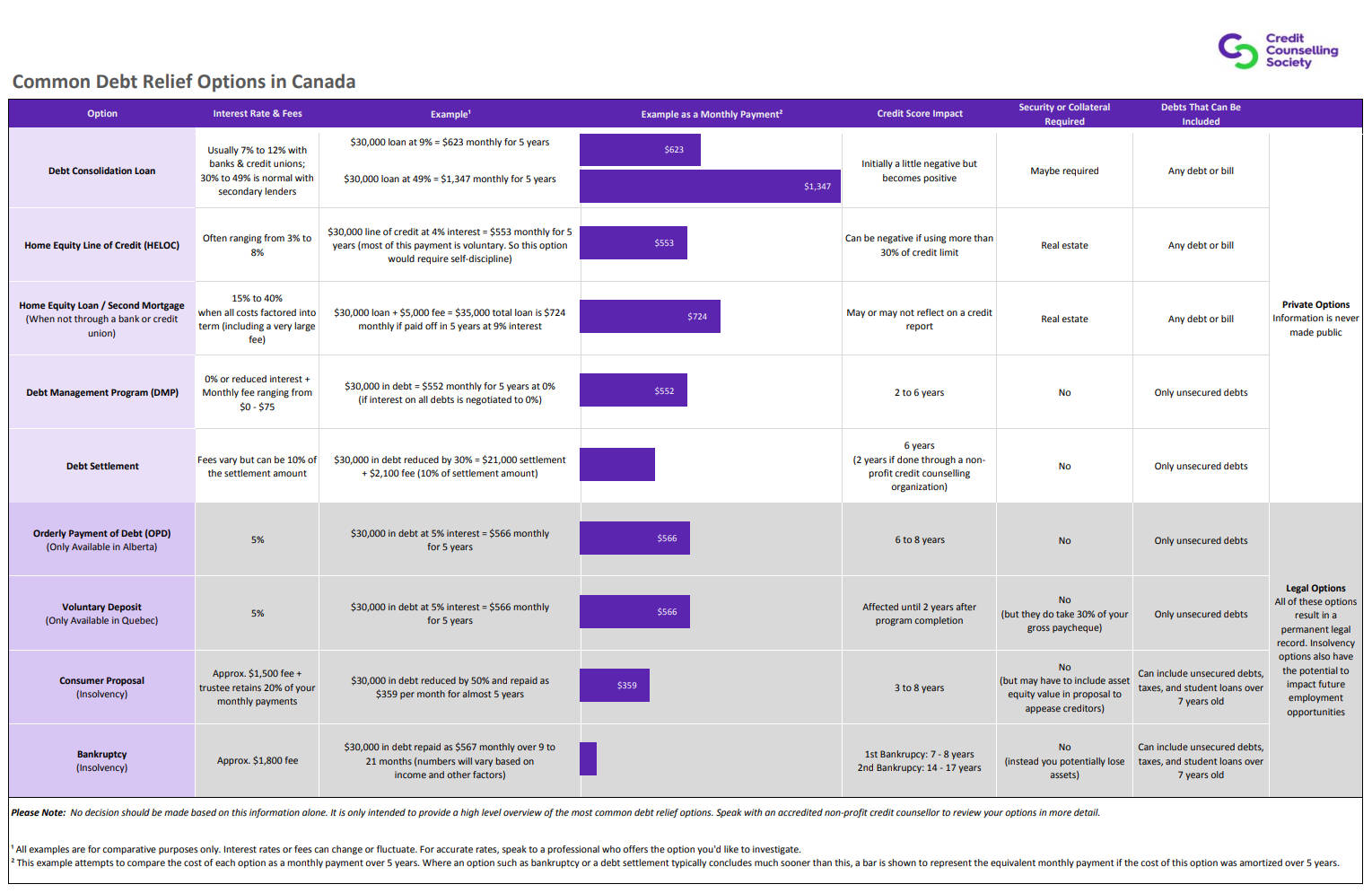

The most popular debt relief and debt consolidation options in Canada.

Consumer Proposal: This program helps you avoid bankruptcy by negotiating with creditors on different terms than the original ones. While the government doesn’t directly provide this program, it regulates the bankruptcy trustees who do.

Bankruptcy: It helps you get a fresh start when you are unable to pay off your debts. You surrender your non-exempt assets to a trustee who sells them and distributes the amount to your creditors. Again, the government doesn’t directly provide this program, but like with Consumer Proposals, it created the rules for this debt relief option with the Bankruptcy and Insolvency Act and regulates the bankruptcy trustees who do.

What is Debt Forgiveness?

Debt Forgiveness is a partial or complete reduction in your debts. It helps you improve your financial situation and avoid bankruptcy when you are struggling with debt. Achieving success with this can be a complex process with many limitations.

There is the possibility that it can happen with different types of loans, like credit cards, student loans, taxes, or mortgages. Debt forgiveness comes with implications, credit damage, and eligibility requirements. It works differently depending on the type of debt you have. For example, if you have credit card debt and the issue is that you can’t pay credit card debt, after many months of you not paying, the issuer could choose to sell your debt to a collection agency, and the agency might be interested in settling the debt for a lower amount than what you owe.

With debt forgiveness, you can save money by paying a lower amount than what you were supposed to pay. It also makes getting rid of debt much faster and avoids further interest charges and fees. It helps in reducing the stress that comes with outstanding debt, and it also helps in improving your cash flow. Although, it does have a negative impact on your credit score. So this isn’t something to be approached lightly and will entirely depend on an individual’s situation. A creditor also needs to have good reason to forgive either a portion or all of a debt. The two most common reasons would be found in the two insolvency options discussed below.

Your Options for Debt Forgiveness in Canada

When you are fed up with collection calls and overbearing debt, debt forgiveness may seem like the perfect solution. There are no official government-backed debt forgiveness programs in Canada. The closest most people can come are by using one of two debt solutions for debt forgiveness that can become legally binding on your creditors.

The first one is bankruptcy, which is the most drastic debt relief option in Canada. It can involve surrendering your non-exempt assets. Each province has specific exemptions, and the whole process is taken care of by a bankruptcy trustee which are now officially called a Licensed Insolvency Trustee (LIT). The trustee will sell any assets that need to be sold and use the proceeds to pay off lenders. For 7 to 8 years from when you file for bankruptcy it will very negatively impact your credit score and your ability to borrow money.

The second option is a consumer proposal, which is often promoted as a less severe option for debt forgiveness in Canada. It is about a bankruptcy trustee making an offer to your creditors to pay only a portion of the debt you owe, thus forgiving the remaining debt. It entirely depends on your creditors whether the proposal is accepted or not. This options is generally thought to prevent you from losing your assets or filing for bankruptcy, but this is not always the case. Unless you have a very legitimate reason to not repay the full amount of your debt, some creditors will accept nothing less than full repayment of the debt they are owed. Getting debt forgiveness is not easy, but fortunately, there are alternatives you could also consider such as a Debt Management Plan. Speak with a credit counsellor to explore all your options and see what may be available to you, or get a quick idea now by just answering 9 short questions further below.

If you’re looking for a creditor to write off a debt on compassionate grounds, you can try using this compassionate write-off sample letter template.

Frequently Asked Questions

Does Canada have a debt forgiveness program?

There are no official government run debt forgiveness programs, and there is no new government program that has just become available. Anything you come across that promotes a narrative like this is misleading and probably trying to sell you something. The only significant thing the Canadian government has done along these lines is to enact bankruptcy legislation in the 1800’s that permits individuals to file for bankruptcy. This legislation has been updated over time with the most recent significant update occuring in 1992 when consumer proposals were added as a debt relief option. Both bankruptcy and consumer proposals are governed by the Bankruptcy and Insolvency Act, and neither of them fully forgive debt. In fact, sometimes a consumer proposal requires repayment of 100% a debt. Both bankruptcy and consumer proposals are administered by the courts and result in a permanent legal record. By law, both options can only be offered by a Licensed Insolvency Trustee. Some debt consultants lead people to believe they offer these programs and charge substantial fees for their services. In Canada, there are other legitimate debt relief programs including the Debt Management Program and Orderly Payment of Debts. Here is an overview of all debt relief options in Canada.

If you or someone you know is in a situation where there is no foreseeable way to ever repay a debt and no debt relief option makes sense for this situation, then you could consider using this template letter to request that the creditor forgive this debt. However, before doing this, we would suggest that you give us a call and at least briefly speak with one of our staff members or credit counsellors to make sure that you don’t have other options.

Is debt relief Canada legitimate?

In Canada, there are many legitimate debt relief options. However, what is not legitimate is a company or individual claiming to offer consumer proposals as a debt relief program if they are not licensed as an insolvency trustee (also known as a bankruptcy trustee). You can check the official list on the Government of Canada’s website. You can also get a better sense of what debt relief options may be available to you by answering these 9 short questions. You can also speak with a non-profit credit counsellor for free, explore your options with them, and then get their help to put together a plan to get your finances back on track as quickly as possible.

How do you qualify for debt relief?

The Quick Answer

Just answer these 9 short questions and you’ll get a pretty good idea of what debt relief options may be available to you.

The Best Answer

Speak with a non-profit credit counsellor. They’ll take a look at your complete financial picture, and then based on what you can realistically afford, they’ll help you explore all your options and narrow down the debt relief options that will help you accomplish your financial goals, get back on track, and get out of debt as soon as possible.

Does debt relief destroy credit?

Debt relief typically has a negative impact on someone’s credit. The effect and degree depend on the option chosen. However, in time, the negative effects of all forms of debt relief eventually go way. The only thing that doesn’t go away is the permanent legal record that results when someone pursues a form of debt relief that involves the courts. This would include bankruptcy, consumer proposals, Orderly Payment of Debt (in Alberta), and Voluntary Deposit (in Quebec). A Debt Management Program is a popular form of debt relief that never involves the courts and never results in a permanent record of any kind.

Do you get money back from debt relief?

You don’t get money back from debt relief unless you have overpaid on a debt relief program. This is not very common as debt relief program payments are designed to be like loan payments. You pay a specific amount every month for say 36 or 58 months and then the program is done.

Does the Canadian government have debt relief program?

No, the Canadian government does not have a debt relief program. There is also no new government debt relief program that has just become available. Anything you come across that puts forward a narrative like this is misleading and likely just a sales pitch. What the Canadian government has done is create bankruptcy legislation in the 1800’s that permited individuals to file for bankruptcy. From a consumer debt relief perspective, the last significant update to this legislation was in 1992 when consumer proposals were added as a debt relief option. Both bankruptcy and consumer proposals are governed by the Bankruptcy and Insolvency Act, and the Act only allows a Licensed Insolvency Trustee, formerly known as a bankruptcy trustee, to provide, administer, and charge fees for either of these sevices. Unfortunatly there are some debt consultants who try to take advantage of unsuspecting consumers and pretend to offer these programs and charge substantial fees for them.

Both bankruptcy and consumer proposals are administered by the courts and result in a permanent legal record. In Canada, there are other legitimate debt relief programs including the Debt Management Program and Orderly Payment of Debts. You can see an overview of all debt relief options here.

It Can Be Hard to Deal with Debt Stress – We Can Help

Let us help you get rid of stress and money worries in your life. If you lose sleep thinking about your debts, your credit cards are maxed or you’re not sure if you can pay all of your monthly bills, you need a solution that won’t get you deeper into debt.

Even if you’ve been declined by your bank when you tried to consolidate your loans, it is possible to get back in control of your credit cards and debts. Regardless of your situation, there is hope that you can be debt free. We are here to help.

Reasons to Make a Debt Relief Plan Today

We can help you:

- Repay your debts with one affordable monthly payment

- Save thousands of dollars in interest

- Look at options to get out of debt and re-establish financial stability

- Pay your bills and living expenses by managing your money better

Contact us now. One of our highly trained, professional Credit & Debt Counsellors would be happy to help you!

Explore Your Options to Get Out of Debt – Choose the Best One

When you start looking at what to do about your debts, it can be hard to know which option will work best. An experienced Credit Counsellor will answer your questions, explain the short and long-term consequences and give you the information you need to make a decision.

Some of the debt relief options and tips a Canadian Credit Counsellor will explain are:

- Debt repayment and consolidation programs to make managing all of your bills and living expenses more affordable.

- Debt management programs where your creditors help you to repay what you owe by waiving or eliminating ongoing interest and fees from things like credit cards or payday loans.

- Assistance with your budget to help you qualify to refinance your existing loan or mortgage.

- Legal options provided by a bankruptcy trustee when you are insolvent. These include referral to a trustee to find out about declaring bankruptcy or filing a Consumer Proposal when you can repay part of what you owe.

- How debt settlement works in Canada, including the advantages and disadvantages. Making one large payment in exchange for the rest of your debt being written off has long term consequences that you’ll want to know about ahead of time.

- How to research the best settlement company for you

- Debt settlement company and find trustworthy reviews.

- How to communicate with creditors, stop stressful collection calls and write a forgiveness of debt letter.

- How to pay off government debt.

Talk to a Credit Counsellor About How to Get Out of Debt

Your Credit Counsellor will explain to you what you need to know so that you can start dealing with your debts right away.

Ultimately, the best option for you to choose will be the one that you can afford to follow through with, and then stay out of debt once and for all.

Find Out Exactly How We Can Help

by Answering 4 Simple Questions

Not sure where to start in finding help for your specific financial situation? Answer these 4 easy multiple-choice questions to get pointed in the right direction. All you have to do is click the boxes that apply to you and then the green button when you're done.

Take the Next Step to Get Help with Your Debts

You’ve got nothing to lose and everything to gain when you contact the right debt relief organization. Last year alone, over 60,000 Canadians asked us for help. 98% of them said they would recommend our service to others. We are also the winner of the 2017 Consumer Choice Award in many cities across Canada.

Give us a call right now to find out how we can help you too. You’ll feel better knowing how to handle your situation.

Get Free, Confidential Debt Help – Talk to a Credit Counsellor Right Now

Having an appointment is free, confidential and you can talk to the Credit Counsellor in person or over the phone. You won’t be obligated to anything by speaking with your Counsellor, and they won’t judge you.

Waiting might only make it worse – Contact us now at 1-888-527-8999.

With the most trusted and highest accredited non-profit credit counselling service available in Canada, what’s holding you back? Get relief from your stress and debt today.

Find out more about the Credit Counselling Society and why people trust us to help them with their money and debt problems.

Last Updated on September 17, 2024

Related Topics

Getting Rid of Debt

We’re happy to help you figure out your options. There are more than you might think.

Insolvency Options

Canada has 2 insolvency options, a consumer proposal or bankruptcy. Find out how they stack up.

Credit Counselling

Are you curious about what credit counselling is or how it works? Here’s what you need to know.

Was this page helpful?

Thanks for letting us know.